Tesla (TSLA)·Q4 2025 Earnings Summary

Tesla Q4 2025: Model S/X Production Ending, $20B+ CapEx as Robotaxi Goes Fully Unsupervised

January 28, 2026 · by Fintool AI Agent

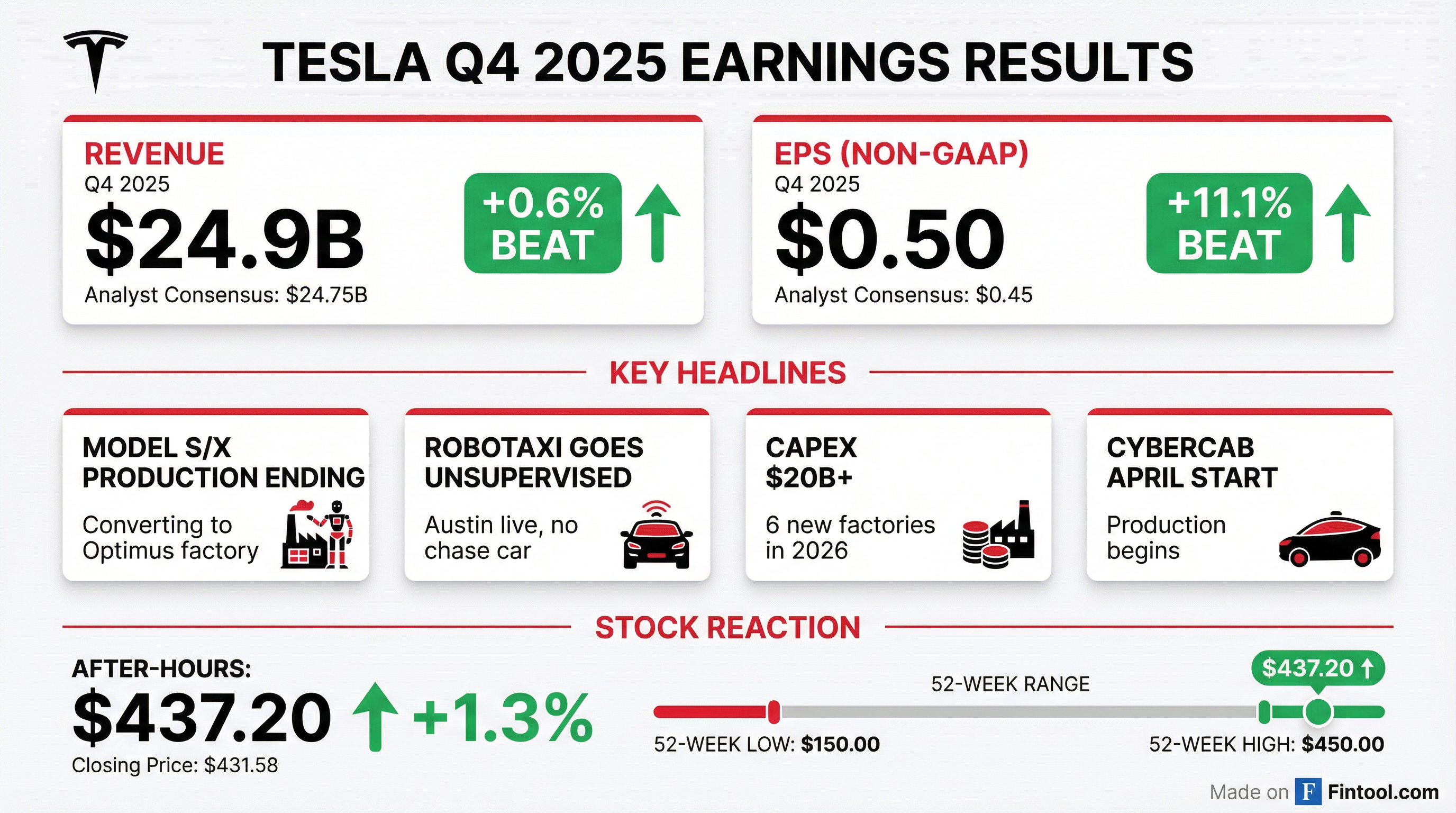

Tesla delivered a double beat in Q4 2025—non-GAAP EPS of $0.50 topped consensus by 11% and revenue of $24.9B edged estimates by 0.6%. But the bigger story: Elon Musk announced Tesla will end Model S and X production next quarter, converting that Fremont factory space to produce Optimus robots at a target rate of 1 million units per year. Meanwhile, Tesla began operating fully unsupervised Robotaxis in Austin—no safety driver, no chase car—a major milestone in the company's autonomous ambitions.

Did Tesla Beat Earnings?

Yes—Tesla beat on both EPS and revenue.

The EPS beat was driven by gross margin expansion to 20.1%—the highest in two years—and record Energy Storage performance, offsetting a 16% decline in vehicle deliveries.

8-Quarter Beat/Miss History

How Did the Stock React?

Tesla shares rose ~1.3% in after-hours trading to $437.20 following the earnings call, after closing at $431.46 (+0.1%) during regular trading.

Key price context:

- After-hours price: $437.20 (+1.3%)

- 52-week high: $498.83

- 52-week low: $214.25

- Current vs. 50-day MA: −1.2% below ($442.31)

The muted after-hours move suggests investors are weighing the mixed signals: strong margin recovery and Robotaxi progress against the Model S/X discontinuation and massive CapEx ramp.

Breaking: Model S and X Production Ending

The biggest surprise of the call: Tesla is discontinuing Model S and Model X production next quarter.

"It's time to basically bring the Model S and X programs to an end with an honorable discharge... If you're interested in buying a Model S and X, now would be the time to order it, because we expect to wind down S and X production next quarter." — Elon Musk

The rationale: Tesla is converting the S/X production space in Fremont to an Optimus robot factory with a long-term goal of 1 million units per year.

This marks the end of an era—Model S launched in 2012 and Model X in 2015. Tesla will continue supporting existing vehicles but is shifting focus entirely to autonomous products.

What Did Management Guide?

CapEx: Over $20 Billion in 2026

Tesla announced a massive CapEx increase—over $20 billion for 2026, more than double the ~$9 billion spent in 2025.

Where the money is going:

- 6 new factories: Lithium refinery, LFP battery plant, Cybercab, Semi, new Megapack factory, Optimus factory

- AI compute infrastructure expansion

- Existing factory capacity expansions

- Robotaxi and Optimus fleet expansion

Not included in the $20B+: potential solar cell manufacturing or the Terafab semiconductor plant, which Tesla is still evaluating.

CFO Vaibhav Taneja on funding: "We have over $44 billion of cash and investments on the books... we've had conversations with banks about [financing the robotaxi fleet]... given that it's an infrastructure play, it's a longer tail."

Tariff Impact: $500M+ in Q4

Tariffs cost Tesla over $500 million in Q4 alone, pressuring margins despite strong pricing discipline. Management expects continued margin compression in Energy from low-cost competition, policy uncertainty, and tariff costs.

Robotaxi and FSD: Major Milestones

Fully Unsupervised Rides in Austin

Tesla hit a watershed moment: paid Robotaxi rides with no safety monitor and no chase car in Austin.

"As of maybe yesterday or so, we actually don't even have a chase car or anything like that. So these are just cars with no people in them, and no one's following the car in Austin." — Elon Musk

Fleet size: Over 500 vehicles carrying paid customers between the Bay Area and Austin. Musk expects the fleet to "probably double every month."

FSD Expansion Plans

- Paid FSD customers: 1.1 million globally, 70% upfront purchases

- Subscription transition: Tesla is moving to subscription-only for FSD, sunsetting upfront purchases

- Geographic expansion: Expects fully autonomous vehicles in 25-50% of the US by year-end, pending regulatory approval. Dozens of major cities planned.

Musk noted that Tesla owners will soon be able to add or subtract their cars to the autonomous fleet "like Airbnb"—potentially earning more from lending their car than their lease payment costs.

2026 Product Roadmap Updates

On Cybercab economics: "The whole design of Cybercab was to optimize the fully considered cost per mile of autonomous driving... we would expect Cybercab to be used probably 50 or 60 hours a week, instead of the 10 or 11 hours a week that a driven vehicle is used." — Musk

Long-term, Tesla expects to make several times more Cybercabs per year than all other vehicles combined, given that 90% of miles traveled involve one or two passengers.

Terafab: Tesla's Semiconductor Play

In a surprise announcement, Musk revealed Tesla is planning to build its own Terafab—a massive semiconductor fab integrating logic, memory, and packaging.

"I think Tesla needs to build a Terafab... even when we look at the best case output of all of our key suppliers—Samsung, TSMC, Micron—it's not enough. So I think in order to remove the constraint in three or four years, we are gonna have to build a Tesla Terafab." — Elon Musk

Why now:

- AI chip production is the limiting factor for growth in 3-4 years

- Geopolitical risk: "There are zero advanced memory fabs at scale in the United States. Literally zero."

- Optimus is "completely useless without an AI chip—it would just sit there"

Musk is personally spending significant time on chip design: "I spend pretty much every Saturday on this and a chunk of every Tuesday."

Q&A Highlights: What Analysts Asked

On China Competition (Humanoid Robots)

"China is an ass kicker next level... I always think people outside of China kind of underestimate China. We think Optimus will be much more capable than any robot we are aware of under development in China." — Musk

Three hardest problems for humanoid robots: (1) incredible hand dexterity, (2) real-world AI, (3) scaling production. Musk believes Tesla is "the only company that actually has all three."

On Memory Constraints

Tesla's AI is "more than an order of magnitude" better in memory efficiency vs. large language models, giving it an advantage in scaling. However, beyond three years, Tesla will be "supplier limited" without additional fab capacity.

On Layoffs

Despite restructuring news across tech, Musk stated Tesla expects to increase headcount at Fremont and significantly increase factory output. "We don't have any layoff plans."

On the xAI Investment

Tesla invested ~$2 billion in xAI's Series E after shareholder requests. Grok will help manage large autonomous fleets and potentially orchestrate Optimus robots for complex tasks.

What Changed From Last Quarter?

Margin Recovery is Real

Gross margin expanded 210 bps sequentially to 20.1%, the highest level since Q4 2023.

Deliveries Down, ASPs Up

Vehicle deliveries fell 16% QoQ due to Q3 demand pull-forward from consumer credit changes, but APAC and EMEA showed strength with records in Malaysia, Norway, Poland, Saudi Arabia, and Taiwan.

Energy Storage: Fifth Consecutive Record

Energy storage deployments hit 14.2 GWh (+29% YoY), with full-year 2025 revenue reaching $12.8B (+27% YoY).

Key Segments Deep Dive

Automotive

Energy Storage

Full-year 2025 energy revenue: $12.8B (+27% YoY).

Capital Position

Tesla ended Q4 with $44.1B in cash, cash equivalents, and investments (+21% YoY).

What to Watch in 2026

- Model S/X wind-down — Final production Q1 2026, Optimus factory conversion

- Cybercab production — April start, S-curve ramp through 2026

- Next-gen Roadster — Potential April debut

- Optimus Gen 3 reveal — "A few months" out, production end of 2026

- Terafab announcement — "Bigger announcement in the future" — Musk

- Robotaxi geographic expansion — Dozens of cities planned, 25-50% of US coverage